The Hidden Costs of Homeownership Most Buyers Overlook

The Hidden Costs of Homeownership Most Buyers Overlook

Introduction

When most people begin dreaming of homeownership, the excitement often centers on the purchase price and calculating the monthly mortgage. But the truth is that the real cost of owning a home stretches far beyond those visible numbers. What often goes unspoken is a series of recurring and sometimes surprise expenses that can accumulate year after year. These hidden costs can have a serious impact on your financial health if you’re not properly prepared.

Homeownership isn’t just a one-time transaction—it’s a long-term financial commitment filled with fluctuating expenses, maintenance responsibilities, and unpredictable variables. Whether you’re moving into a sleek high-rise condo in downtown Atlanta, a cozy mid-century ranch in Decatur, or a historic bungalow in East Point, understanding what lies beyond the sticker price is crucial.

If you fail to plan for these hidden costs, you risk:

Falling behind on mortgage payments and damaging your credit

Dipping into emergency savings prematurely or taking on new debt

Delaying essential repairs or upgrades, which may reduce property value

Facing penalties, late fees, or even foreclosure

Experiencing buyer’s remorse or unexpected financial stress

Having to sell or refinance sooner than planned

Neglecting your quality of life due to tight monthly cash flow

Below, we’ll explore the most commonly overlooked—and underestimated—expenses tied to owning a home. These insights go beyond the obvious to equip you with practical, strategic knowledge. The more informed you are, the more empowered you’ll be to protect your investment and enjoy your property with peace of mind.

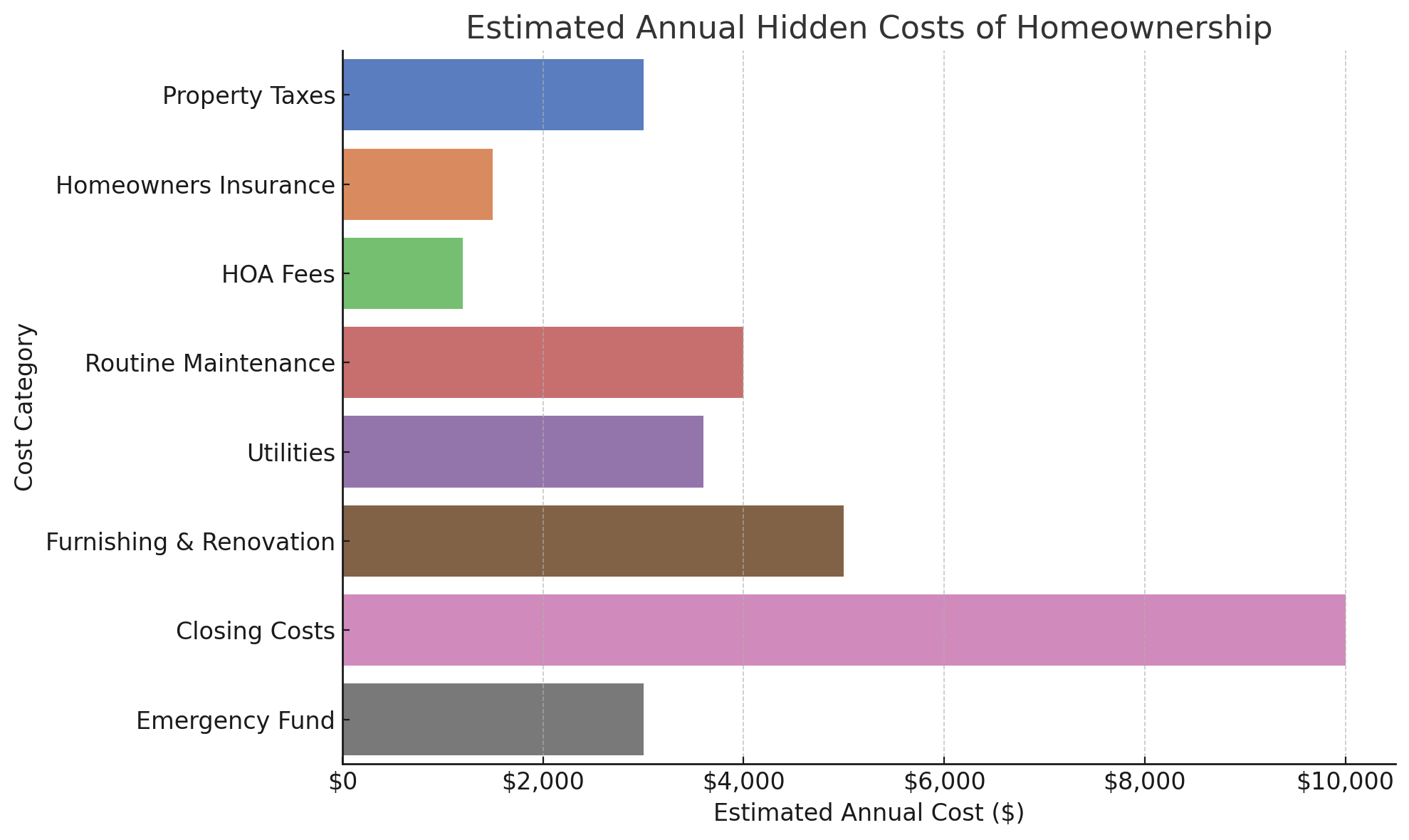

Estimated Annual Hidden Costs of Homeownership

This chart outlines the typical hidden costs homeowners encounter annually. Actual expenses may vary by location, home size, and lifestyle, but planning within these ranges creates a realistic financial roadmap.

1. Property Taxes

Determined by your local city, county, and school district

Reassessed annually and influenced by home improvements, sales activity, or inflation

Typically paid monthly through escrow, bundled with your mortgage

Higher taxes are common in districts with top-rated schools or extensive city services

May increase substantially after renovations or if the home was recently purchased

Bonus Tip: Many new homebuyers don’t realize that newly constructed homes may have artificially low first-year tax bills (based on the land alone). Once the home is reassessed with structures included, taxes can increase substantially.

Extra Considerations:

Watch for upcoming referendums or bond measures that may impact rates

If moving to a different county, research local exemptions or homestead credits

Understand appeal rights in case of an inaccurate or high assessment

Use your tax bill to estimate future escrow adjustments

2. Homeowners Insurance + Supplemental Policies

Required by lenders to protect your property investment

Premiums influenced by zip code, property age, roof condition, security features, and claim history

May not include flood, windstorm, earthquake, or sewer backup protection

Claims can increase premiums or make you ineligible for renewal

Quick Checklist:

Ask for the property’s C.L.U.E. report to view the insurance claim history

Review exclusions and deductible structures for different types of coverage

Compare quotes from multiple carriers and ask about bundling with auto or umbrella policies

Evaluate add-ons like loss-of-use coverage or personal property riders

Consider inflation protection and extended replacement cost coverage

3. HOA Fees & Special Assessments

Ranging from $50 to $1,000+ per month, especially in townhome or condo communities

Cover maintenance of shared spaces like pools, parks, sidewalks, and security gates

May include trash removal, pest control, insurance for common areas, and landscaping

Boards may issue special assessments for capital repairs not covered by reserves

Important Due Diligence:

Read all HOA covenants, bylaws, and recent meeting minutes

Ask for the current reserve study to evaluate the association’s financial health

Find out about any litigation or disputes that may affect future fees or resale value

Research architectural controls that may limit your design or landscaping choices

4. Routine Maintenance & Long-Term Repairs

Annual rule of thumb: save 1–2% of home’s value for ongoing upkeep

Regular tasks include: changing air filters, servicing HVAC, flushing water heater, sealing windows, repainting trim

Long-term wear may require deck refinishing, roof repairs, or plumbing replacements

Pest prevention, tree pruning, chimney cleaning, and appliance calibration all factor in

Average Lifespans:

Roof: 20–30 years (asphalt shingles)

HVAC systems: 10–15 years

Water heater: 8–12 years

Washer/Dryer: 10–13 years

Kitchen appliances: 10–15 years

Exterior paint/stain: 5–7 years

Pro Tip: Preventative maintenance is cheaper than emergency fixes. Set calendar reminders and create a quarterly home checklist.

5. Utilities, Municipal Services & Sustainability Costs

Monthly bills for:

Electricity and natural gas

Water, sewer, and storm drainage

Trash collection and curbside recycling

Cable, high-speed internet, and optional landline

Security monitoring and lawn care (if not DIY)

Sewer line insurance or maintenance contracts in older neighborhoods

Sustainability Note:

Investing in energy-efficient windows, solar panels, or a tankless water heater can reduce long-term expenses

Smart thermostats and LED lighting help cut electric bills

Some cities offer rebates for eco-friendly upgrades or rainwater systems

Composting, low-flow toilets, and drip irrigation can further reduce water bills

6. Furnishing, Decorating & Personalizing Your Home

Even “turnkey” homes rarely meet all your aesthetic preferences

Budget for:

Beds, dressers, sofas, dining tables

Curtains, blinds, and blackout shades

Rugs, lamps, wall art, shelves

Accent walls, cabinetry hardware, and outdoor furniture

Home office desks, patio heaters, grills, or garden installations

Post-Move Budget Tip: Separate your renovation and furnishing budget from your emergency or operating funds. Otherwise, you may overspend before unexpected costs hit.

7. Closing Costs & Escrow Prepaids

Commonly range from 2% to 5% of the purchase price

Cover services such as:

Title search and title insurance

Appraisal, home inspection, and survey

Lender origination, underwriting, and processing fees

Attorney and recording fees

Escrow prepaids include:

6–12 months of homeowners insurance

3–6 months of property taxes

Daily prorations based on closing date

Caution: Rolling these costs into your loan increases your total interest paid and monthly obligation.

Additional Tip: Always request a Loan Estimate and compare at least three lenders. Look for junk fees hidden under different labels.

8. Emergency Fund & Unplanned Home Expenses

Essential for covering:

Leaky roofs or foundation cracks

Fallen tree removal or driveway sinkholes

Sudden HVAC or water heater failures

Plumbing backups or appliance malfunctions

Termite damage, mold remediation, and structural surprises

Goal: 3–6 months of total expenses + $3,000–$10,000 earmarked for home-related surprises

Finance Tip: Use a high-yield savings account labeled “Home Emergencies” and set an automatic transfer to build it slowly.

9. Inflation, Renovations & Lifestyle Changes Over Time

Costs increase over time:

Annual property tax assessments

Higher insurance premiums due to regional disasters

Rising utility and municipal rates

HOA fee adjustments based on inflation

Life events impact needs:

Children, aging parents, or roommates

Remote work renovations or adding a home office

Expanding storage, outdoor areas, or adding square footage

Adaptability Advice: Revisit your household budget annually and track expenses to prepare for evolving needs.

10. Legal, Permit & Compliance Risks

Unpermitted additions or code violations can cause resale delays or fines

Some repairs (e.g., fences, water heaters, decks) require permits

You may need to update electrical, plumbing, or HVAC systems to meet current codes

Title disputes, boundary issues, or easements may require legal intervention

Proactive Approach: Work with a reputable real estate agent and request detailed seller disclosures. Always order a comprehensive home inspection and ask about previous renovations.

Additional Tip: Document any repairs, upgrades, or permits as you go. They’ll add value during resale and reduce liability.

Conclusion

Buying a home is more than securing a mortgage—it’s embracing a lifestyle of stewardship, investment, and responsibility. From taxes and insurance to furniture and future-proofing, hidden costs are a reality every buyer must confront. Planning for these expenses early will reduce stress, protect your finances, and allow you to enjoy the true benefits of homeownership.

Whether you’re buying your first home or building a legacy property, success comes down to knowledge and preparation.

At Brique Realty, our mission is simple: transparency, education, and empowerment. We’re here to guide you every step of the way:

Financial preparation and pre-approval

Choosing properties aligned with your budget

Understanding long-term ownership costs

Connecting you with vetted inspectors, lenders, and contractors

Ready to own with confidence? Let’s build your future—day by day, brick by brick.

Related Posts:

Down Payment Assistance Programs in Georgia

Should You Rent or Buy in Atlanta Right Now?

Homeowner Tax Tips Every Georgia Resident Should Know