Atlanta’s Hidden Goldmine: How the 2025 ADU Boom Can Add Six‑Figures to Your Home Equity

Unlock Six‑Figure Equity & Reliable Rental Income in Your Own Backyard

1. Why ADUs Are Exploding in Atlanta

Atlanta’s housing crunch is more than a headline—it’s reshaping neighborhoods. The metro welcomed 65 000 new residents in 2024 and has started 2025 on a similar trajectory. Single‑family inventory sits at decade lows, rent growth outpaces inflation, and interest rates keep owners locked into their existing mortgages. Into this pressure cooker walks the Accessory Dwelling Unit (ADU)—a code‑compliant backyard home that unlocks new living space, a fresh stream of rental income, and a big shot of equity without forcing the owner to move.

Key signals driving the boom

Search momentum: Google Trends shows a 140 % year‑over‑year jump in “ADU financing Atlanta.”

Legislative tailwinds: Georgia’s Gentle Density bill removes red tape around minimum lot sizes and parking mandates, letting cities green‑light backyard cottages by right.

Demographic demand: Millennials (now the nation’s largest cohort) are hitting peak household‑formation age. Simultaneously, one in five Georgians will be 65+ by 2030, fueling demand for downsized, in‑law‑friendly housing.

Rent pressure: Median one‑bed leases for $1 629 per month—and furnished mid‑term units top $2 000.

Investor appetite: Institutional money is pouring into “missing‑middle” housing, but small infill lots remain the domain of individual owners—meaning you can compete.

The upshot? If you have an under‑utilized backyard, garage, or basement, 2025 may be the single best year in a decade to capitalize.

2. ADU Foundations: Four Formats, Endless Uses

Although “ADU” covers any secondary dwelling on a single‑family lot, Atlanta code most often sees four versions:

• Detached Cottage (DADU)

– 400–750 sq ft, single‑story, max 20 ft height. Perfect for aging parents, college grads, or traveling nurses seeking mid‑term housing.

• Attached Suite

– Adds square footage onto the main house yet provides its own entry, kitchen, bath, and HVAC. Favorite play for narrow intown lots.

• Garage / Basement Conversion

– Lowest cost because the shell is already there. Confirm ceiling height (≥ 7 ft), egress windows, and waterproofing.

• Carriage House Over a Garage

– Studio apartment atop new or existing garage. Stairs add cost, but every finished foot appraises at full value.

Code check: A kitchenette with an induction cooktop and convection microwave counts as a full kitchen, bypassing Atlanta’s ban on second 240‑volt ranges in basement suites.

3. The Payoff: Equity, Cash Flow, Lifestyle Flexibility

Equity lift. Brique Realty comps show compliant ADUs boosting resale by 20–35 %—often $80 000–$110 000 on a mid‑tier intown home.

Cash flow. Long‑term leases at $1 600 +/mo and mid‑term stays near $2 000 leave owners with $450–$900 net monthly after vacancy, maintenance, and interest.

Lifestyle versatility. A tenant today can become a home office, art studio, or aging‑parent suite tomorrow. Flexibility itself is saleable.

Resale magnet. Buyers pay premiums for homes with built‑in rental income—especially when borrowing costs remain elevated.

4. Rules & Regulations—Decoded

Atlanta’s ordinance is friendlier than ever, but these guardrails still matter:

Size & height: Max 750 sq ft or 30 % of the primary home; detached units limited to one story and 20 ft roof peak.

Lot coverage: Most R‑4 lots must stay below 45 % total building footprint, and large tree canopies count. Hire an arborist early.

Owner occupancy: You, a family member, or your tenant must occupy either the main house or the ADU full‑time.

Parking: Since Sept 2024, no extra off‑street space is required citywide, though select historic districts still enforce it.

Short‑term rentals: Hold both STR Type A (primary) and Type B (secondary). Type B nights capped at 180 per year—ample for 30‑ to 90‑day stays.

Permitting timeline: Typical review takes 6–8 weeks; construction averages 6–8 months. Inspectors can verify proof of funds before issuing permits—line up financing first.

5. Cost Breakdown—Where the Money Really Goes

A detached cottage currently runs $145 000–$195 000 in metro Atlanta. Use these ranges when planning:

Hard construction

Site work & foundations … $15 000–$25 000

Framing & shell … $45 000–$55 000

Mechanical, electrical, plumbing … $30 000–$40 000

Interior finishes … $20 000–$30 000

Soft costs

Architectural plans … $4 000–$7 000

Structural engineer … $1 800–$3 200

Survey, tree report, site plan … $1 500–$2 500

Permits & impact fees … $3 000–$4 500

Site extras

Utility tie‑ins … $6 000–$15 000

Tree removal / root protection … $1 500–$5 000

Retaining walls, drainage, grading … $2 000–$6 000

Contingency

Keep 10 % of total budget in reserve for lumber spikes, weather delays, or scope creep.

Build methods & typical price bands

Site‑built stick … $190–$270 / sq ft (7‑month schedule)

Prefab modular … $160–$210 / sq ft (5‑month schedule; add crane + delivery fees)

Container … $140–$190 / sq ft (4‑month schedule; some lenders discount value)

6. Financing Deep Dive—Nine Paths to Yes

HELOC (80 % LTV) – 10‑year interest‑only draw; July‑25 rates sit near 7.0 %.

Cash‑out refinance – Replaces your first mortgage; makes sense if existing rate > 5.5 %.

FHA 203(k) Limited – 3.5 % down, funds up to $75 000 in renovation costs.

FHA 203(k) Standard – Finances up to 110 % of ARV; HUD consultant required.

Fannie Mae HomeStyle® – 95 % LTV; allows sweat equity for up to $75 000.

HomeReady® + First‑Gen – Counts 75 % of projected ADU rent toward borrower income.

DSCR Construction Loan – Underwrites property cash flow, not personal DTI; rates mid‑8s.

PACE‑like energy financing – Rolls payments into property tax bill for high‑efficiency builds.

Local grants & rebates – Invest Atlanta offers $10 000 forgivable if rented to seniors ≤ 60 % AMI; federal tax credits cover 30 % of solar and heat‑pump upgrades.

Pro tip: Stack incentives—a $10 000 grant plus a 30 % energy credit on a $12 000 solar package reduces your net cost to $1 400 while boosting appraised value.

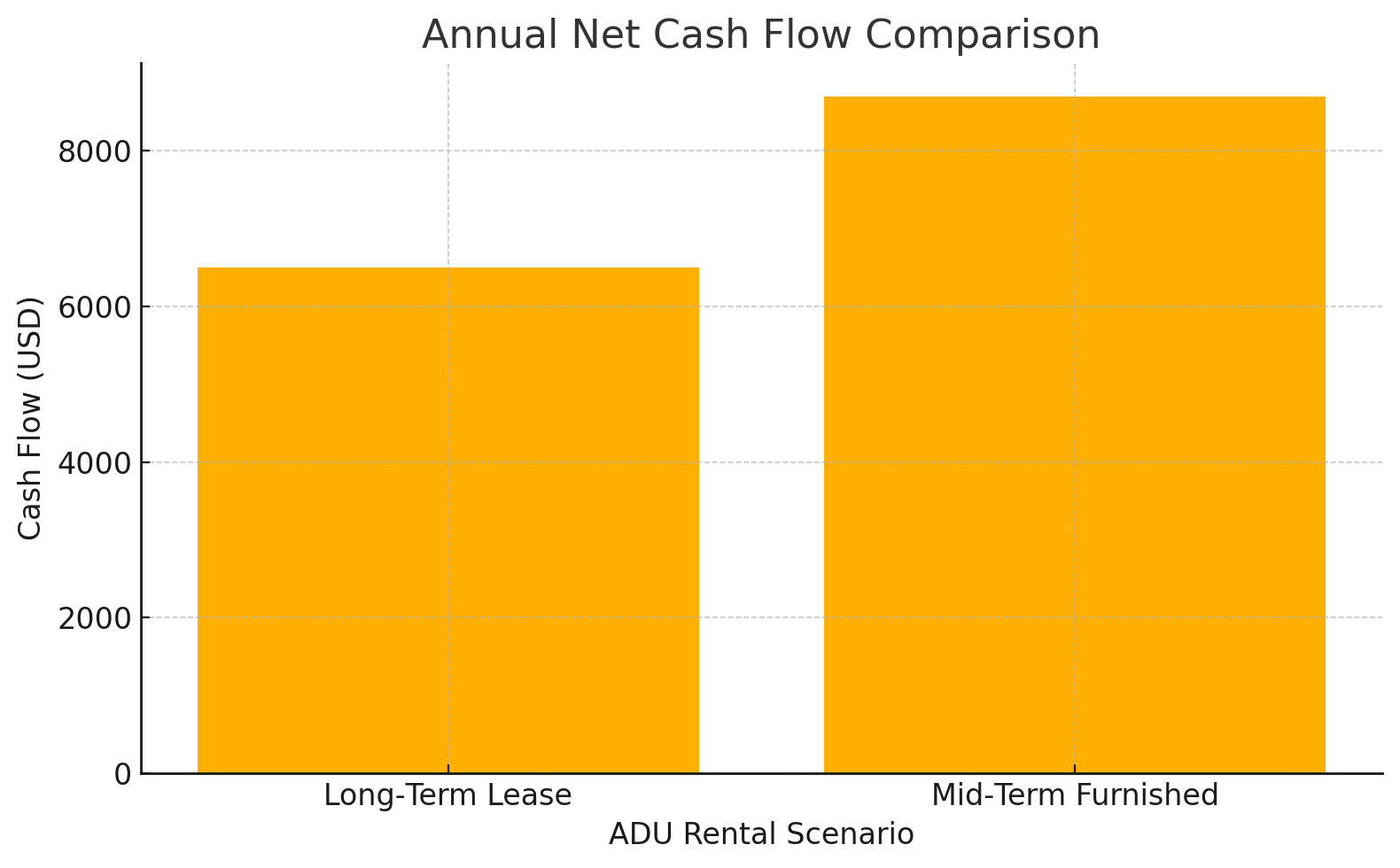

7. Will It Cash‑Flow? Two Scenarios

Scenario A—Long‑Term Lease

Unit: 720 sq ft cottage, $168 000 build cost, 75 % HELOC @ 7 %.

Gross rent: $1 629/mo.

Vacancy & maintenance (13 %): -$212.

Net operating income: $1 417.

Optional management (10 %): -$142.

HELOC interest: -$736.

Net cash flow: $539/mo (≈ $6 500/yr) → 32 % cash‑on‑cash on $20 000 invested.

Scenario B—Furnished Mid‑Term (Travel Nurse)

Gross rent: $2 050/mo.

Furnishings & turnover reserve: -$175.

Vacancy & maintenance (12 %): -$246.

Management (8 %): -$164.

Net operating income: $1 465.

HELOC interest: -$736.

Net cash flow: $729/mo (≈ $8 700/yr) → 44 % cash‑on‑cash on the same $20 000.

Breakeven rent under either model is ≈ $1 325, giving a healthy cushion below market.

8. Design & Amenity Choices That Command Premiums

Modern Farmhouse – White board‑and‑batten, black windows, matte‑metal roof; +15 % Airbnb ADR.

Scandinavian Minimalist – Blonde pine, vault ceilings, skylights; photographs beautifully on listings.

Aging‑in‑Place Suite – Zero‑threshold entry, 36‑in doors, curbless shower; appeals to seniors and mobility‑challenged renters.

Net‑Zero Studio – Solar‑ready trusses, heat‑pump HVAC, energy‑recovery ventilation; 30 % federal tax credit and lower utility bills.

Smart‑Home Package – Keyless entry, smart thermostat, whole‑home Wi‑Fi; reduces lockout calls and attracts tech‑savvy tenants.

9. Maintenance & Operating Costs—Plan Ahead

Even the best‑built ADU needs upkeep. Budget:

Annual HVAC service … $150

Roof inspection every 3 years … $250

Pest control … $35–$45/mo

Landscaping (if separate) … $50–$75/mo

Capital reserve (set aside 5 % of rent) … covers future repaint, appliance swaps, etc.

Proactive maintenance protects cash flow and keeps your tenant‑review score high—a hidden driver of rent growth.

10. Insurance & Liability—Cover Your Bases

Structure coverage – Add your ADU’s replacement cost to your homeowner policy or obtain a separate landlord policy.

Liability umbrella – A $1 million umbrella often costs under $250/yr and protects against tenant injury claims.

Loss of rent endorsement – Covers missed rent if a covered peril (fire, storm) forces your tenant out.

STR riders – Many carriers now offer affordable short‑term rental endorsements; disclose up front.

Quick win: Bundling an umbrella with home and auto often offsets 50 % of the extra premium—ask your agent.

11. Future‑Proofing: Looking Toward 2030

Electric‑vehicle charging – A 40‑amp circuit and inexpensive wall charger future‑proof the unit for growing EV adoption.

Gig‑fiber conduit – Running an empty 1‑in conduit today avoids tearing up drywall when fiber hits your street.

Universal design – Wider halls and lever handles add pennies per foot now and broaden your tenant pool for decades.

Climate resilience – Cool‑roof coatings, enhanced insulation, and permeable pavers keep energy and storm‑water costs down as summers get hotter and storms stronger.

12. Sample Project Timeline—From Idea to Income

Weeks 1–2 – Feasibility: Verify setbacks, sewer capacity, tree impact.

Weeks 3–6 – Concept & budget: 3‑D model, refine costs to ±15 %.

Weeks 7–10 – Finance lock: Appraisal, HELOC or renovation loan secured.

Weeks 11–14 – Permit package: Submit civil, structural, storm‑water, and energy sheets.

Month 4 – Groundbreaking: Utilities marked, footings poured.

Month 5 – Framing & roofing: Weather‑tight shell complete.

Month 6 – MEP rough‑ins: Plumbing, electrical, HVAC inspections.

Month 7 – Insulation & drywall: Pass blower‑door test (< 3 ACH50).

Month 8 – Interior finishes: Cabinets, flooring, fixtures, paint.

Month 9 – Final inspections & CO.

Month 10 – List & lease: Stage photos, set rent, screen tenants.

13. Taxes, Depreciation, & Exit Strategies

Depreciation – A $160 000 structure written off over 27.5 years yields about $5 800/yr in paper loss.

Cost segregation – Reclassifies short‑lived assets (appliances, landscaping) into 5‑, 7‑, and 15‑year buckets—often adding $18 000+ in first‑year deductions.

Primary residence exclusion – Live on‑site two of five years to exclude up to $250 000 (or $500 000 MFJ) in capital gains.

1031 exchange – After one year as a rental, roll gains into larger multifamily property tax‑deferred.

Step‑up basis – Heirs inherit at fair market value, wiping depreciation recapture.

14. Common Pitfalls & How to Dodge Them

Appraisal gaps – Provide rental comps, contractor bids, and an ADU‑specific appraisal addendum to your lender.

Utility surprises – Always camera‑scope sewer lines and pull an as‑built map; undersized mains can add $10 000+.

Contractor drift – Hold back 10 % retainage and build daily penalties into the contract.

HOA covenants – Some communities ban second dwellings regardless of city policy; read CC&Rs before paying for drawings.

Insurance lapses – Inform your carrier in writing; unpermitted STR activity can void coverage.

15. Case Study: Westview Backyard Cottage

Lot: 50 × 150 ft

Build: 720 sq ft DADU, modern farmhouse style

Timeline: 7.5 months groundbreak to lease

Total cost: $164 250 (incl. contingency)

Financing: $120 K HELOC @ 6.9 %, owner cash $44 250

Rent: $1 680/mo, 12‑month lease

Net cash flow first year: $6 920 after all expenses

Equity boost: Home appraised $102 000 higher post‑CO

Owner takeaway: HELOC interest + maintenance covered; cash‑out refinance planned for month 18 to recycle capital into second ADU on investment property.

16. Bottom Line: 2025 Is the Window

Material costs have plateaued, code reforms favor gentle density, and loan products increasingly welcome projected ADU rent. Waiting risks higher labor prices, tighter credit, and longer contractor lead‑times. Build now to lock in equity growth, enjoy predictable cash flow, and gain the flexibility to age in place—or help loved ones do the same.

Ready to explore your own backyard’s earning potential? Request a complimentary feasibility audit from Brique Realty today and receive a personalized ROI projection within one week.